Avoiding Senior Identity Theft Scams

Protecting personal information and being vigilant helps seniors prevent financial loss from identity theft.

Understanding Senior Identity Theft

Senior identity theft is a growing concern as more older adults are using the internet for banking and shopping. Many seniors often find themselves unwittingly falling prey to identity theft scams that can lead to devastating financial fraud. Studies show that those aged 65 and over are more likely to be targeted due to their limited familiarity with technology. It's crucial to be informed and take preventive measures to safeguard your personal information.

Types of Identity Theft Scams

Identity theft scams can take many forms: online scams, phishing scams, and even medical identity theft. Scammers may impersonate trusted organizations to gain access to your Social Security Number or bank account details. They might also engage in credit card fraud or try to manipulate you into sharing your personal information under false pretenses. Recognizing these scams is the first step in avoiding them.

The Risks of Financial Fraud

Financial fraud can occur in various forms, including bank account fraud and credit card fraud. Victims may face significant losses and endless hours spent resolving issues with financial institutions. Unfortunately, older adults can be especially vulnerable. With less experience in online security, seniors might not notice warning signs as quickly as younger generations. Understanding the risks assists in developing a proactive approach to securing one's finances.

Protecting Your Personal Information

To avoid falling victim to identity theft, protecting your personal information is essential. Never give out your Social Security Number, credit card number, or banking details unless you are absolutely sure about the legitimacy of the request. Be cautious while sharing information online, especially on unfamiliar websites. A safe practice is to install quality antivirus software that includes web protection; this helps filter out malicious sites that may harbor threats.

Be Vigilant Against Phishing Scams

Phishing scams are particularly deceptive, often mimicking legitimate organizations to steal sensitive data. Email and text messages claiming to be from the IRS or Medicare might look genuine but could be designed to dupe you into revealing your personal information. Always double-check the sender's address, and if in doubt, contact the organization directly using their official website or customer service line.

Medical Identity Theft: A Hidden Threat

Medical identity theft is a disturbing trend that can lead to fraudulent medical claims charged to your name. This type of theft is particularly alarming as it can impact your medical records and lead to significant health issues. Always monitor your medical statements and insurance claims. Being aware and checking for any unfamiliar treatments or services billed to you can help catch medical fraud early.

Spotting Medicare Fraud

Medicare fraud is a serious concern, especially for seniors. Fraudulent practices can involve everything from billing for services not rendered to overcharging for supplies. Be acute in reviewing details on your Medicare Summary Notice. Report any discrepancies right away! The sooner you act, the more likely it is to stop the fraud in its tracks. For more insights, check out the guide available at Equifax.

How to Safeguard Against Irs Scams

Similar to Medicare fraud, IRS scams can happen via phone calls or email. Scammers often claim to be IRS agents demanding urgent payment. If you receive a call or an email like this, do not respond immediately. The IRS typically communicates via traditional mail. Always verify through official channels before acting. For further details on your rights and protections, visit GPOFCU.

Dealing with Identity Theft: What to Do?

If you suspect that you've fallen victim to an identity theft scam, act quickly. First, report the issue to your bank and credit card companies. They can monitor your accounts for unusual activity and take necessary measures to secure your funds. Additionally, contact the Federal Trade Commission (FTC) to officially report the identity theft. Finally, consider consulting with a professional, like a senior identity theft lawyer, who can guide you through the recovery process and help protect your rights.

Final Thoughts

Senior identity theft is an alarming issue, but with knowledge and vigilance, you can protect yourself from identity theft scams. Maintaining awareness of potential threats, securing your personal information, and acting quickly in the event of fraud will help you navigate the digital world with confidence. Trust your instincts—if something feels off, it probably is!

Posts Relacionados

Alerts For Seniors Be Prepared

Seniors should know emergency alerts for safety. Prepare and stay informed for quick responses during crises.

Anomaly Detection In Network Traffic Using Deep Learning

Deep learning analyzes network paths to identify unusual patterns, improving traffic monitoring and network performance significantly.

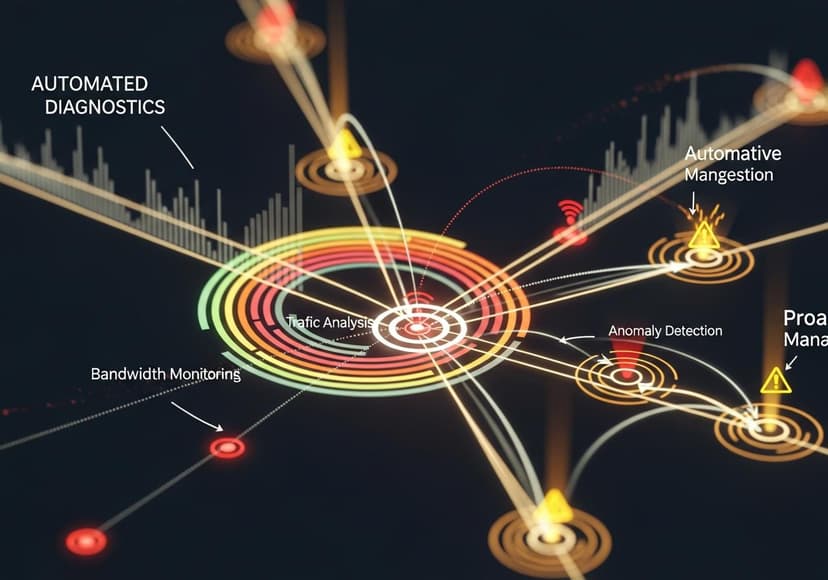

Automated Network Fault Detection

Proactive monitoring and diagnostics improve network performance. This approach ensures optimal connectivity and service reliability.